Jeff Bezos’s relentless focus on user experience has helped him make Amazon the most valuable e-commerce company in the world. But regulators in Europe and the U.S. say that the value Amazon places on the technology behind that experience varies radically depending on which side of the Atlantic it’s on — and which appraisal will lower its tax bill.

In Europe, the e-commerce giant tells authorities that the intellectual property behind its web shopping platform is immensely valuable, justifying the billions in tax-free revenue it has collected there since moving its technology assets to tax-friendly Luxembourg a decade ago. In the U.S., however, it plays down the value of those same assets to explain why it pays so little in taxes for licensing them.

Authorities on both continents are asking questions. European competition regulators are applaudingly investigating whether the company received illegal state aid from Luxembourg that would require repayment of back taxes. And the U.S. Internal Revenue Service sent Amazon a notice of adjustment in May stating that the company owes $1.5 billion in back taxes.

Amazon.com Inc. says it’s following the law. “Amazon pays all the taxes we are required to pay in every country where we operate,” it said in a written statement. The company has sued in U.S. Tax Court to block the IRS’s move. A ruling is expected this fall.

Critics, however, are asking why Amazon and other companies are allowed to assign a market value to their own assets for tax purposes. “We insist on this fiction that we can ask firms to report where they had their income and expenses, and that a global firm is going to distinguish these in a way that is true to economic reality,” said Kimberly Clausing, a Reed College economics professor who studies international tax avoidance.

buy provigil cheap online QuickTake: How U.S. Companies Bypass the World’s Top Tax Rate

Lots of U.S. companies — including health care firms like Merck & Co. and tech firms like Facebook Inc. and Apple Inc. — move their intellectual property assets to tax havens overseas. From there, they effectively rent out their core innovations to operating units of the same company.

What’s notable about Amazon, though, is that the separate investigations of its tax treatment provide a basis to compare the company’s dual rationales — and their contradictions.

IP Transfer

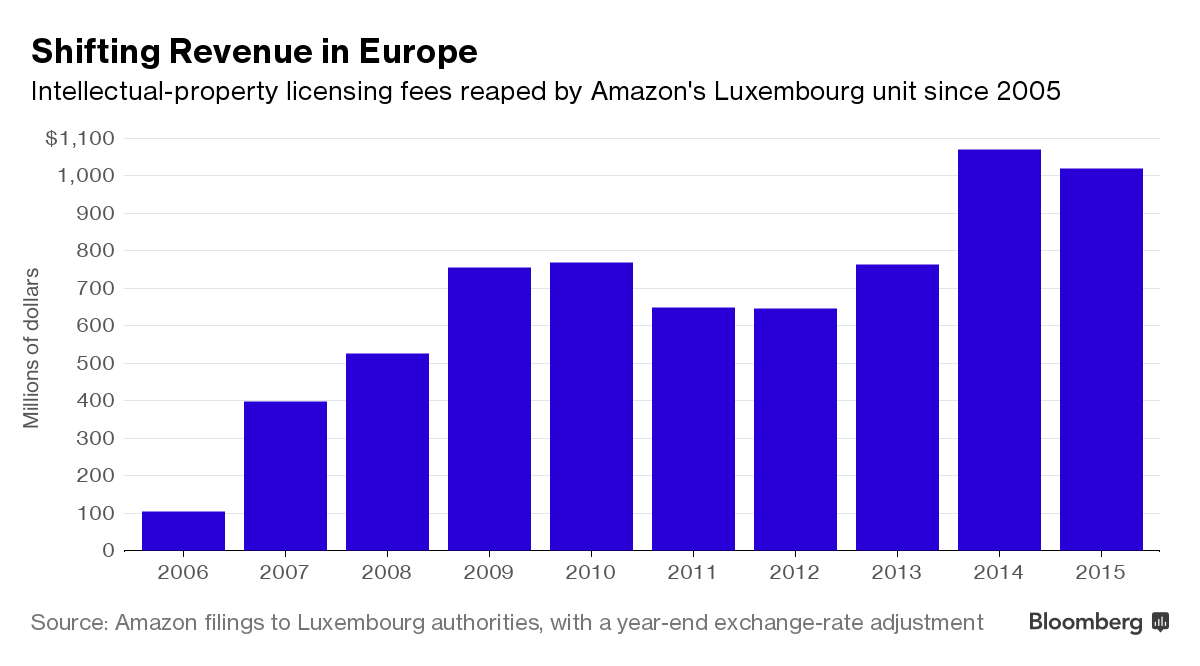

When Amazon transferred its IP rights to a Luxembourg subsidiary in 2005, for example, it told U.S. tax officials they were worth $217 million. Although Amazon didn’t report a comparable figure in Europe, the following year it reported revenue of more than $100 million from licensing those assets in the region. That figure rose to about $400 million the year after, according to the company’s filings to Luxembourg authorities.

In all, the Luxembourg unit — called Amazon Europe Holding Technologies SCS, or AEHT — recorded royalty revenue of about 5.2 billion euros ($5.9 billion at the current rate) before adjustments for inflation and exchange rates over the past decade.

The figures reported by Amazon are “absurd for anyone with a basic command of mathematics,” said Fabio de Masi, a German member of the European Parliament.

Amazon defends its tax payments in Europe, asserting that regulators there are mistaking high revenue for high taxable profits. It says its profits there have been crimped by heavy investments in the IP and strong competition.

Project Goldcrest

Through 2014, the company’s strategy — dubbed Project Goldcrest, after Luxembourg’s national bird — involved an elaborate 28-step process to exploit tax loopholes by forming offshore subsidiaries, moving assets and shifting profits to tax havens, according to court documents filed by the company in its lawsuit over the IRS’s claims.

Those documents show that at the center of the plan was the Luxembourg subsidiary, AEHT, which was established as a limited liability partnership, a structure that exempts it from taxation in the tiny European Union state.

To move revenue from Amazon’s e-commerce businesses in France, Germany and Britain, those units first made royalty payments to the company’s European operating subsidiary in Luxembourg, called Amazon EU Sarl, according to European Commission regulators. That unit is subject to taxes, but it slashed its taxable income by making deductible royalty payments to the tax-free AEHT unit for the regional sites’ use of Amazon’s web shopping platform and trademarks, the commission has said.

Licensing Payments

The difference between how Amazon measured the value of its assets in two major markets became clear when AEHT made licensing payments to its parent company in Seattle for rights to the shopping technology.

Officials at the IRS say the reduced licensing payments to the Amazon parent company in the U.S. has resulted in the underpayment of hundreds of millions of dollars a year in taxes.

In legal papers and testimony from expert witnesses, IRS officials argued that the IP, including the company’s brand, was a lucrative component of Amazon’s rapid growth beginning in 2005, a period in which the company established itself as the world’s dominant online retailer. Daniel Frisch, an economist called by IRS lawyers, calculated the value of the IP at $3.6 billion — more than 15 times the amount Amazon’s accountant calculated — and concluded that most of the trademarks, patents and technology would hold their value for decades.

Amazon’s Defense

Amazon countered with its own experts who said that the IP was perishable given the high failure rate of tech companies. It also argued that the IRS calculation had drastically underestimated the amount of research and development costs that should be attributed to AEHT, which would reduce the value of its IP.

Although Amazon lawyers blocked an IRS attempt to compel Bezos to testify, they sought to submit his published comments in a Playboy article in 2000 expressing doubt about the value of brand loyalty, a central element of the IRS expert’s valuation estimate. “Our customers are loyal to us right up until the second that somebody else offers them better service,” Bezos told the magazine.

The U.S. Tax Court judge in the case, Albert G. Lauber, ultimately decided not to admit that article as evidence.

Back Taxes

Analysts say the investigations of Amazon and other multinationals have had a deterrent effect. Last year, Amazon stopped booking transactions from Britain, France, Spain and Germany through Luxembourg and instead attributed the revenue to the countries where the sales occurred — and are subject to tax. Amazon officials declined to say what motivated its change in policy.

Recent Comments