Each year, the IRS mails millions of notices and letters to taxpayers for a variety of reasons. This can be extremely upsetting when receiving this form of communication, whether it is from the IRS or any other taxing authority. The following tips are presented to reduce your anxiety and to provide a specific action plan for any correspondence received from the IRS (or from your state or local taxing authority):

- http://sargeantstudios.net/?p=104 Don’t Panic: You can usually deal with a notice simply by responding to it. You should immediately contact your tax attorney, CPA or tax adviser to discuss this matter in more detail.

- purringly Tip: Waiting can only compound and complicate your tax problems.

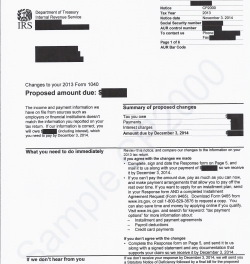

- Most IRS notices are about federal tax returns or tax accounts: Each notice has specific instructions, so read your notice carefully because it will tell you what you need to do. Follow the instructions very carefully. The goal here is to give a specific and detailed response to the tax issue in question.

- Tip: Only respond to the particular issue and do not provide or discuss issues that are not being raised by the IRS.

- Taxes You Owe or Payment Request: Your notice will likely be about changes to your account, taxes you owe or a payment request. However, your notice may ask you for more information about a specific issue.

- Tip: Do not assume that the taxes owed are correct. In many cases, the IRS calculates taxes without all the relevant facts.

- Review: If your notice says that the IRS changed or corrected your tax return, review the information and compare it with your original return.

- Tip: Once again, just because the IRS says you owe taxes does not mean that they are correct. Contact your tax attorney, tax accountant or tax adviser immediately.

- If You Agree: If you agree with the notice, you usually don’t need to reply unless it gives you other instructions or you need to make a payment. If you choose not to respond to the IRS be sure you understand the IRS letter and its implications, because the next step from them is usually an assessment of additional taxes.

- If You Do Not Agree: If you don’t agree with the notice, you need to respond within the time limit set out in the notice. Write a letter that explains why you disagree, and include information and documents you want the IRS to consider. Mail your response with the contact stub at the bottom of the notice to the address on the contact stub. Allow at least 30 days for a response from the IRS.

- Tip: It is usually prudent to have your tax attorney, CPA or tax adviser craft a well-conceived response that is supported with references to the relevant facts of your situation and the tax law in question.

- How To Contact The IRS: For most notices, you won’t need to call or visit a walk-in center. If you have questions, call the phone number in the upper right-hand corner of the notice. Be sure to have a copy of your tax return and the notice with you when you call.

- Tip: Be careful when talking with the IRS; they are not your friend. Only speak to the specific issues in question.

- Keep All Notices, Letters and Correspondence: Always keep copies of any notices you receive with your tax records.

- Tip: If things get complicated, you want to have a full record of correspondence to present to a tax attorney or tax adviser. So by all means do not throw anything away while this tax matter is still in dispute.

- Warning: Be alert for tax scams: The IRS sends letters and notices by mail. They don’t contact people by email or social media to ask for personal or financial information. If you owe tax, you have several payment options.

- Tip: The IRS won’t demand that you pay a certain way, such as prepaid debit or credit card or money order.

- For more on tax scams please read Renewed Warning: IRS Tax Scam Alert and What To Do To Protect Yourself: Scary and Disturbing Tactics By Phony IRS Agents

Recent Comments